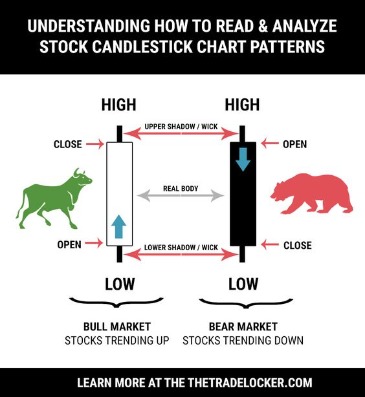

Best Chart And Candlestick Signals For Trades

P Iklan ini diterbitkan pada: 21 September 2020 , Kategori: Forex Trading

- Nomor Iklan: 4769

- Dilihat: 97 kali

- U Hubungi Pengiklan

- Nama: adffdd sdfesdf

- Domisili: asfsaf, Kepulauan Bangka Belitung

- Lihat semua iklan dari member ini - 4775 iklan

- Tips: Lakukan transaksi dengan cara bertemu langsung dengan penjual dan mari bersama kita bangun budaya jual-beli yang aman dan sehat

- Ingat! Hindari membayar dimuka & hati-hati dengan iklan yang tidak realistis.

Pengiklan berdomisili di asfsaf, Kepulauan Bangka Belitung.

Deskripsi ] Best Chart And Candlestick Signals For Trades

The second try gave us a beautiful confirmation with the Dark Cloud Cover pattern. The effort in that first candle dwarfs the efforts of the bulls. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Stay on top of upcoming market-moving events with our customisable economic calendar. There are two types of Engulfing patterns – Bullish Engulfing Pattern and Bearish Engulfing Pattern.

Best stock market course bundle deal – Mashable

Best stock market course bundle deal.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

Below are some types of bullish reversal patterns everyday traders ought to know. Because intraday trading is very volatile, a trader must consider several aspects before placing an entry. Just because a candlestick pattern predicts a reversal or continuation doesn’t guarantee it will occur every time. Pay close attention to the market conditions and what price action is intending to tell you. These are displayed graphically on a chart, which is utilized for market analysis. Our guide to reading candlestick charts is a great place to start to learn how to interpret candlesticks for trading.

After the wick formed on the 15 minute chart, we define the extreme price zone of the wick as an opportunity zone. Well we will assume that if price retraces back to the extreme of the wick that formed, that buyers will once again be the aggressor at those price levels. Finally, let’s take a look at a few of my favorite candlestick patterns.

Plan your trading

Once again, both are nothing more than consolidation patterns. Again, it’s not necessary to remember the names, they’re all simply consolidation patterns. Now that you have an understanding of consolidation, it’s time to look at some different examples. The tighter the spring was compressed (longer price consolidated), the more force behind the initial breakout. I’m going to teach you several different types of patterns including Consolidation Patterns, Structural Patterns, and Candlestick Patterns. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

- A bullish candlestick pattern is a useful tool because it may motivate investors to enter a long position to capitalize on the suggested upward movement.

- Many candlestick patterns rely on price gaps as an integral part of their signaling power, and those gaps should be noted in all cases.

- There can be a few discretionary entries on this pattern depending on experience.

- If it is followed by another up day, more upside could be forthcoming.

The pattern includes a gap in the direction of the current trend, leaving a candle with a small body (spinning top/or doji) all alone at the top or bottom, just like an island. A hammer suggests that a down move is ending (hammering out a bottom). Note the long lower tail, which indicates that sellers made another attempt lower, but were rebuffed and the price erased most or all of the losses on the day. The important interpretation is that this is the first time buyers have surfaced in strength in the current down move, which is suggestive of a change in directional sentiment. Traditionally, candlesticks are best used on a daily basis, the idea being that each candle captures a full day’s worth of news, data, and price action. This suggests that candles are more useful to longer-term or swing traders.

What is a bearish candlestick pattern?

An engulfing line is a strong indicator of a directional change. A bearish engulfing line is a reversal pattern after an uptrend. The key is that the second candle’s body “engulfs” the prior day’s body in the opposite direction.

If you’ve never built a trading strategy, your next step should be reading our guide on trading strategies and developing a playbook. Loose definitions lead to strategies that aren’t repeatable, and red trading accounts. Practice spotting them on your charts and you will see how powerful they can be. Inverted Pins create high R opportunities as they allow you to have a really tight stop right below the swing. The following patterns are very simple, yet can be extremely powerful when the proper context is applied. The final structural patterns we will look at are ABCD patterns.

Is Day Trading With Charts Easy?

Who is in control (greed), who is weak (fear), to what extent they are in control, and what areas of support and resistance are forming. In recent history, Steve Nison is widely considered the foremost expert on Japanese candlestick methods. After all, he wrote the book that catapulted candlestick charting to the forefront of modern market trading systems. It is such patterns that technical traders study to gauge the future direction of price.

- Thankfully, a lot of the work has been done for us – four centuries ago, actually.

- Backtesting is also an excellent way to use charts and indicators.

- Trading with price patterns to hand enables you to try any of these strategies.

- Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

- The gap occurs due to a space between the high and low of the two bullish candlesticks due to high trading volatility.

The 1 minute chart is our trigger chart where we will look for an entry. The 15 minute chart we will use to build context and find a logical place to take an entry. Candlestick charts can trace their roots all the way back to the 18th century and Japanese rice traders. The Cup & Handle pattern was first defined by swing traders a long time ago. Second, it’s provides you with a logical spot to place your stop loss order, below the swing low.

Technical Indicators

We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. 72% of retail client accounts lose money when trading CFDs, with this investment https://g-markets.net/ provider. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

For example, if there is an uptrend, if a down candle forms but stays within the upper half of the last upward candle, little damage is done to the trend. A hanging man pattern suggests an important potential reversal lower and is the corollary to the bullish hammer formation. The story behind the candle is that, for the first time in many days, selling interest has entered the market, leading to the long tail to the downside. The buyers fought back, and the end result is a small, dark body at the top of the candle. Confirmation of a short signal comes with a dark candle on the following day. Typically, we like to use bearish candlestick patterns to sell stocks.

If the close of the trading day is above the open on the chart, then the body of the rectangle will be white. Similarly, if the close of the trading best candlestick patterns for day trading day is below the open on the chart, then the body of the rectangle will be red. Day trading can be a lucrative venture if you do it properly.

Why These Patterns Work

The good news is there are also lots of completely free day trading charts. You get most of the same indicators and technical analysis tools that you would in paid-for live versions. You will also find some of the free options offer a space for traders to follow experienced investors, and discuss instruments and markets with each other. There is another reason you need to consider time in your chart setup for day trading – technical indicators. You may find lagging indicators work the best with less volatility, such as moving averages.

The first thing you need to look at when analyzing candlesticks is the period. If the chart is a daily one, it means that each candlestick represents a day. Similarly, if the chart is a five-minute one, each bar represents five minutes.

This suggests that, in the case of an uptrend, the buyers had a brief attempt higher but finished the day well below the close of the prior candle. This suggests that the uptrend is stalling and has begun to reverse lower. Also, note the prior two days’ candles, which showed a double top, or a tweezers top, itself a reversal pattern. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. This makes them more useful than traditional open, high, low, and close (OHLC) bars or simple lines that connect the dots of closing prices. Candlesticks build patterns that may predict price direction once completed.

?r Iklan Terkait Best Chart And Candlestick Signals For Trades

UK Inflation Calculator: GBP from 1751 to 2023

Content U.K. Inflation Rate Calculator from 1665 through 2023 More From economy Technical Analysis: Pound Sterling maintains rising channel breakout Producer Price Index (PPI) vs. Consumer... Selengkapnya)

What Is Consumer Discretionary? Definition in Economic Indicators

Both product classifications are influenced by cycles of the economy. For our 12 Best Consumer Discretionary Stocks to Buy list, we chose 12 leading consumer... Selengkapnya)

Лайм ФХ is a Renowned Brokerage Company Trusted Forex Broker Center with the tightest spreads and the flexible leverage

To start your journey, visit the official Лайм ФХ website and navigate to the Лайм ФХ MT4 download page. Ensure that you download the correct... Selengkapnya)