What is Ratio Data? Definition, Characteristics and Examples

P Iklan ini diterbitkan pada: 9 December 2020 , Kategori: Bookkeeping

- Nomor Iklan: 4116

- Dilihat: 120 kali

- U Hubungi Pengiklan

- Nama: adffdd sdfesdf

- Domisili: asfsaf, Kepulauan Bangka Belitung

- Lihat semua iklan dari member ini - 4775 iklan

- Tips: Lakukan transaksi dengan cara bertemu langsung dengan penjual dan mari bersama kita bangun budaya jual-beli yang aman dan sehat

- Ingat! Hindari membayar dimuka & hati-hati dengan iklan yang tidak realistis.

Pengiklan berdomisili di asfsaf, Kepulauan Bangka Belitung.

Deskripsi ] What is Ratio Data? Definition, Characteristics and Examples

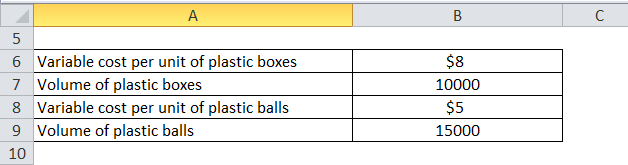

While interval and ratio data can both be categorized, ranked, and have equal spacing between adjacent values, only ratio scales have a true zero. The following parametric tests are some of the most common ones applied to test hypotheses about ratio data. Now that you have an overview of your data, you can select appropriate tests for statistical inferences. With a normal distribution of ratio data, parametric tests are best for testing hypotheses. After you’ve collected ratio data, you can gather descriptive and inferential statistics.

Inefficient use of assets such as motor vehicles, land, and building results in unnecessary expenses that ought to be eliminated. Financial ratios can also help to determine if the financial resources are over- or under-utilized. Consider the inventory turnover ratio that measures how quickly a company converts inventory to a sale. A company can track its inventory turnover over a full calendar year to see how quickly it converted goods to cash each month. Then, a company can explore the reasons certain months lagged or why certain months exceeded expectations. A company may be thrilled with this financial ratio until it learns that every competitor is achieving a gross profit margin of 25%.

OCT-based deep-learning models for the identification of retinal key … – Nature.com

OCT-based deep-learning models for the identification of retinal key ….

Posted: Tue, 05 Sep 2023 11:40:45 GMT [source]

Ratio analysis is incredibly useful for a company to better stand how its performance compares to similar companies. By its definition, ratio analysis is a process to scrutinise and compare financial data of a company using its financial statements. This method actively uses the data from financial statements to calculate the financial health and performance of a company.

Financial Statements and Ratio Analysis

To make better use of their information, a company may compare several numbers together. This process called ratio analysis allows a company to gain better insights to how it is performing over time, against competition, and against internal goals. Ratio analysis is usually rooted heavily with financial metrics, though ratio analysis can be performed with non-financial data. This prevailing method primarily helps the management of a company as well as its investors to gather information on its growth percentage. Besides, this method also clarifies the operational drawbacks of an organisation.

- Thus, the company may need to borrow money from outside sources to cover all of its pending debt.

- Furthermore, every analyst has their technique to evaluate and interpret ratios and their knowledge of the subject.

- Those ratios are the debt-to-asset ratio, the times interest earned ratio, and the fixed charge coverage ratios.

- In general, the lower the ratio level, the more attractive an investment in a company becomes.

- By plotting quantitative variables on a graph, you can determine the direction and strength of correlation between the different variables.

It determines an organization’s profitability concerning the capital invested in the business. A business with a 20% or more ratio value is profitable. Let us determine the gross profit ratio of Apple Inc for 2022. Let us determine the operating cash flow ratio of Walt Disney Co for 2022. We get the following financials from its consolidated balance sheet and cash flow statement from the annual report.

Repayment Capacity Ratio

It is a quantitative tool that is used to assess all financial ratios formulas of the business. Ratio analysis formulas help to update the company’s liquidity, operational efficiency, and profitability by studying all financial ratios formulas. Also called activity ratios, efficiency ratios evaluate how well a company uses its assets and liabilities to generate sales and maximize profits. Key efficiency ratios are the asset turnover ratio, inventory turnover, and days’ sales in inventory. Examples of solvency ratios include debt-equity ratio, debt-assets ratio, and interest coverage ratio. Efficiency ratios measure the ability of a business to use its assets and liabilities to generate sales.

The most common way to measure frequency distribution is to represent your data using a pivot table or some kind of graph. For example, the bar graph here shows the distribution of weight in a sample of marlins. The former may trend upwards in the future, while the latter will trend downwards until it matches with its intrinsic value. Let us calculate the earnings per share for both stocks. Let us calculate the cost of Investment and the net profit.

Disadvantages of Ratio Analysis

Solvency ratios calculate the debt levels of a company in relation to its assets, annual earnings and equity. Some of the important solvency ratios that are used in accounting are debt ratio, debt to capital ratio, interest coverage ratio, etc. Since companies in the same industry typically have similar capital structures and investment in fixed assets, their ratios should be substantially the same. Many analysts use ratios to review sectors, looking for the most and least valuable companies in the group. Liquidity ratios provide a view of a company’s short-term liquidity (its ability to pay bills that are due within a year).

Debt-Equity Ratio of Paypal Holdings

Let us determine the Debt-Equity ratio of Paypal Holdings for 2021. Low Debt-Equity Ratio

As Ramp-up Ltd. had a ratio of 1.87 in 2022, which was lower than 2, it started using less debt for funding its business and is less risky. However, the ratio should not fall below 1, as it can mean the firm has higher liabilities which is not a good sign. Low Return on Equity Ratio

As Lorens Lane Ltd. had a ratio lower than 15% in 2022, the company did not use the shareholder’s invested money effectively.

Let us determine the fixed assets turnover ratio of Apple Inc for 2022. We get the following financials from Apple’s annual report. Investors and analysts employ ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. Comparative data can demonstrate how a company is performing over time and can be used to estimate likely future performance. This data can also compare a company’s financial standing with industry averages while measuring how a company stacks up against others within the same sector. Companies use a wide array of ratio analysis types to understand the financial condition and position within a sector.

Analyze Investments Quickly With Ratios

Another fixed charge would be lease payments if the company leases any equipment, a building, land, or anything of that nature. Larger companies have other fixed inherent risk vs control risk charges which can be taken into account. But, if the receivables turnover is way above the industry’s, then the firm’s credit policy may be too restrictive.

Ratio analysis enables investors to efficiently analyse the financial status of companies by evaluating their past as well as their current financial statements. The comparative data can help predict the performance of the company over time and its future performance as well. These ratios show how well a company can generate profits from its operations.

COMPANY DETAILS

When analyzing the return on equity ratio, the business owner also has to take into consideration how much of the firm is financed using debt and how much of the firm is financed using equity. Companies can also use ratios to see if there is a trend in financial performance. Established companies collect data from the financial statements over a large number of reporting periods.

Charting a Course Through Rough Seas: How Emerging Markets … – International Monetary Fund

Charting a Course Through Rough Seas: How Emerging Markets ….

Posted: Fri, 01 Sep 2023 09:21:58 GMT [source]

The total return they received after selling those shares after a year was $270 per share. Profitability ratios measure a firm’s operational competence. It also evaluates the utilization of available resources to generate profit.

The first ratios to use to start getting a financial picture of your firm measure your liquidity, or your ability to convert your current assets to cash quickly. Let’s look at the current ratio and the quick (acid-test) ratio. One of the uses of ratio analysis is to compare a company’s financial performance to similar firms in the industry to understand the company’s position in the market.

It also tells if the company can pay them off while they are due. They depict if the cash and cash equivalents are enough to cover the short-term debt commitments. The total-debt-to-total-assets ratio is used to determine how much of a company is financed by debt rather than shareholder equity. It seems that a very low fixed asset turnover ratio might be a major source of problems for XYZ. The company should sell some of this unproductive plant and equipment, keeping only what is absolutely necessary to produce their product. There are three debt management ratios that help a business owner evaluate the company in light of its asset base and earning power.

?r Iklan Terkait What is Ratio Data? Definition, Characteristics and Examples

9 1 Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions Principles of Accounting, Volume 1: Financial Accounting

Content Recognize Revenue When Your Business Satisfies a Performance Obligation Revenue Recognition Principle (IFRS): Definition, Using, Formula, Example, Explanation Revenue Recognition: The Backbone of Accurate... Selengkapnya)

Detection of transposition errors in decimal numbers IEEE Journals & Magazine

Content How to Locate and Rectify Transposition Errors Hack 38. Find Transposition Errors How to correct a transposition error Want More Helpful Articles About Running... Selengkapnya)

Free On Board FOB Shipping: Meaning, Incoterms & Pricing

Content What is the Difference Between FOB and CIF? FOB Shipping Point, Freight Prepaid and Charged Back Proven Insights of Managing Your Logistics in Transportation... Selengkapnya)