Invoice Billing and Management Process Best Practices

P Iklan ini diterbitkan pada: 18 April 2022 , Kategori: Bookkeeping

- Nomor Iklan: 3004

- Dilihat: 106 kali

- U Hubungi Pengiklan

- Nama: adffdd sdfesdf

- Domisili: asfsaf, Kepulauan Bangka Belitung

- Lihat semua iklan dari member ini - 4774 iklan

- Tips: Lakukan transaksi dengan cara bertemu langsung dengan penjual dan mari bersama kita bangun budaya jual-beli yang aman dan sehat

- Ingat! Hindari membayar dimuka & hati-hati dengan iklan yang tidak realistis.

Pengiklan berdomisili di asfsaf, Kepulauan Bangka Belitung.

Deskripsi ] Invoice Billing and Management Process Best Practices

It represents the backbone of cash flow and the basis for trust and transparency in every transaction. Invoicing clients may be a time-consuming chore, but it is the most effective method for keeping your business running smoothly. Project management and invoicing software can assist you in streamlining the invoicing process. Follow these best practices for invoicing if you want to get paid on time and avoid the stress of not getting paid. Make sure you have a good way to send out invoices so that your cash flow is good and you have few problems getting paid. Consider activating read receipts if your bookkeeping/invoicing software or email service supports them to be notified when your customer opens the invoice.

So, sending requests within a reasonable time before the deadline is crucial. Timely and consistent billing is essential to secure your company’s cash flow. In reality, the process for small business invoicing doesn’t come so easy (thanks to our beautiful invoicing software). Our online invoicing solution factors in all of the best practices we’ve mentioned above making it the best tool for small businesses looking to do invoicing the right way. By implementing these best practices, you’ll be well on your way to mastering invoicing and payment management for your remote team and ensuring the long-term success of your small business. Clearly outline your expectations regarding time tracking, billing, and expense management to avoid any ambiguity.

Are there any templates available to create an invoice?

When it comes to accounts receivable, discrepancies and errors in the billing process are quite costly. And the cost to the business is about more than just the money…errors that lead to disputes can cause friction and mistrust between sellers and their buyers. If you use invoicing software, it will have templates to help you create a professional invoice that includes key client details.

Stay informed about specific sales tax regulations in each state for accurate invoicing. Keep your funds in USD to cover local expenses like taxes or online purchases. Seamlessly transfer funds to other Payoneer users through Payoneer to Payoneer payments, utilizing your Payoneer balance. Local bank transfers, such as ACH bank debit, are widely favored by US businesses due to their low fees and quick processing. However, there are some considerations to remember, especially if you don’t have a US bank account. Now you know the best small business invoicing practices that can help you streamline your invoice process.

Written by Invoice

Professional invoice paper was designed to ensure accuracy, improve security, and has the potential to reflect positively on your brand image. There are several practices that are necessary for operating the most effective, efficient, and professional invoicing processes. Most employees will hate doing it, and if you’re using a manual process, you can accrue a lot of errors which doesn’t help your invoicing process at all.

3 Investments That Will Transform Your Small Business – Entrepreneur

3 Investments That Will Transform Your Small Business.

Posted: Fri, 11 Aug 2023 07:00:00 GMT [source]

This enables them to quickly scan and locate the necessary information for making payments, leading to faster payment processing. What’s more challenging for small business owners rather than completing your job? Many of you may even struggle to send invoices to clients on time. Businesses use past-due invoices if customers do not pay their balance on time. A customer can send an invoice that is past due for late payments based on the type of policy.

Address the Client

Encourage open communication channels or mobile apps to address any concerns or questions related to invoicing and payment. For remote teams across different countries, establish a currency and exchange rate conversion policy to avoid confusion during invoicing and payments. Specify the billing cycle (e.g., monthly, bi-weekly) and the invoicing process for different types of services or projects.

How to Receive Money on PayPal – CitizenSide

How to Receive Money on PayPal.

Posted: Thu, 17 Aug 2023 17:19:48 GMT [source]

In this case, it is best to have a collections team member contact the client to discuss the various options, one of which is extending the payment due date. Invoice factoring results in a more user-friendly billing process and enhances client connections. Traditionally, invoicing has printing and mailing physical invoices, but those are very costly.

It can be very time-consuming and expensive, however, e-invoicing and automation platforms can simplify the process and reduce errors. This will help companies to gain their payments faster and improve their cash flow. If an issue occurs regarding an invoice, it is crucial to address it by contacting the client and figuring out the best way to solve the situation. One of the best ways to improve your invoicing process is to outline clear expectations with each new client or customer. Be sure to include details such as payment schedules and estimated amounts in each invoice.

Compliance and Taxation

Below are the 6 simple invoicing tips that will help you maintain a smooth cash flow. Yes, a client should pay a business within a month of receiving the invoice. Moreover, since automation reduces errors, you can minimize the risk of delays or other issues with the help of accurate information. This is why it’s a good idea to prepare a W-9 for each supplier before you go through with their payment. Taking the time to scan and enter each incoming invoice in your system might feel cumbersome, but getting rid of these invoices early can reduce the chance of making errors. To digitize paper data, you might need intelligent data-capturing software, but investing in these solutions is worthwhile considering its endless benefits.

Three crucial pieces of information to include on your invoice are the total amount due, the due date, and the terms of payment. This keeps everybody on the same page, and makes sure everything is clear for both parties. If appropriate, also include instructions to “make check payable to” the entity name you prefer.

A supplier portal lays the foundation for an inclusive business relationship and lets you maintain trust with your vendors. You must ensure that everyone in the AP department is on the same page about policies for handling exceptions and approval deadlines. If that wasn’t enough, paper archives are also vulnerable to physical damage, and years’ worth of records can get destroyed easily in case of an accident. Download our guide to Invoice Security for more insight into how Corcentric can improve your invoicing security today.

- To streamline invoice workflow, it’s essential to enter new invoices into your AP system on the same day as you receive them.

- We all love getting paid quickly, and the best way to make this happen is to manage your invoices well.

- If a client disputes the added fees, make sure you have it written in the signed contract how much they would pay.

- While invoices do not need to be ordered chronologically, it is important to incorporate an ID system to ensure that each invoice number is unique and does not repeat.

- We’re well into the 2020s, and that’s excellent news as far as different global payment solutions are concerned.

These are, in most cases, inadvertent errors; however, consider how this can lead to an invoice being delivered with multiple errors or, worse yet, to the wrong location. Now consider how that could lead to your AR team having to contact the customer regarding payment for an invoice that customer never received. You now have an annoyed customer whose invoices will now have to be corrected, resulting in delayed payments. Cash flow is the life blood of businesses, but if that cash isn’t flowing in a timely and accurate fashion, the business and its goals will suffer.

Once you have the right fee structure, it’s important to use a project management software that lets you create an invoice based on the fee structure you picked. You can also explain the invoicing process to them before they even sign the contract. If a client is nitpicking costs and asking you to create tons of task-based line items for each invoice, it could be a warning sign. Essentially, it means not over-complicating the invoice with jargon or extending the layout to multiple pages.

For example, you can write an invoice number like B001, CN002, or BL001. There are multiple steps involved in accurate invoice processing, with three main steps involved in the process, with each step involving multiple tasks. The invoice total should be followed by one or two lines detailing the accepted deposit methods. Again, you may be able to expedite the payment procedure if your client has the option to pay by phone or online. The monthly books also permit you to send invoices per your record entries. In addition, it allows you to cross-reference invoices with account balances for each customer.

Depending on the type of invoicing software or EIPP platform you choose, you may have a choice of payment gateways to facilitate the payment process. The payment gateway is provided by a bank or other financial institution and will allow customers to use a variety of payment methods securely online. The benefits of cloud-based software for businesses are widely known. Good software helps you accurately track receivables, including the invoices you’ve sent, if they’ve been viewed, what’s been paid and what invoices are outstanding.

Even if delivery is not automated, sending invoices as PDFs may not be sufficient enough to address all issues with invoicing. Using an accounts receivable (AR) automation platform like Versapay, you can eliminate manual invoicing and automate this process. In turn, it facilitates efficient payments and reduces days sales outstanding (DSO).

Once your client agrees to work with you, set expectations again about all the payments and invoice workflows in the form of a letter of agreement, which forms the basis for your contract. It’s an opportunity for you to explain to your client what value you provided, and at the same time it’s a great way to build up trust by having transparency in your invoicing. Additionally, you can easier answer questions later on, if your client gets back to you with a question or two. Quite the contrary, they should be a well thought through part of your communication strategy.

A report by Entrepreneur found that small businesses have an average of £84,000 tied up in unpaid invoices at any given time, which is bad news for cash flow to say the least. The invoicing best practices to follow to get paid on time and avoid the overall stress of not receiving payments. Keep a good invoicing workflow to keep your cash flow good and payment issues to a minimum. At Paystand, we’re industry leaders in digital payment processing and know-how to invoice a client digitally.

This number lets corporations identify transactions pertaining to their corresponding clients. While invoices do not need to be ordered chronologically, it is important to incorporate an ID system to ensure that each invoice number is unique and does not repeat. Businesses can use invoices to monitor their inventory and Invoicing best practices prepare for upcoming sales and purchases. They assist the financial department to plan ahead and allocate the funds appropriately. Businesses present invoices as official documentation to comply with tax regulatory requirements. The statement can also include information about the quality standards of the product.

?r Iklan Terkait Invoice Billing and Management Process Best Practices

Detection of transposition errors in decimal numbers IEEE Journals & Magazine

Content How to Locate and Rectify Transposition Errors Hack 38. Find Transposition Errors How to correct a transposition error Want More Helpful Articles About Running... Selengkapnya)

Trust Accounting & Bookkeeping for Law Firms in BC, Canada by ProFix

Content Interest in Lawyers Trust Accounts (IOLTA) Invite Your Accountant Keep an eye on trust accounting Seamlessly Migrate From Your Current Accounting Software It’s best... Selengkapnya)

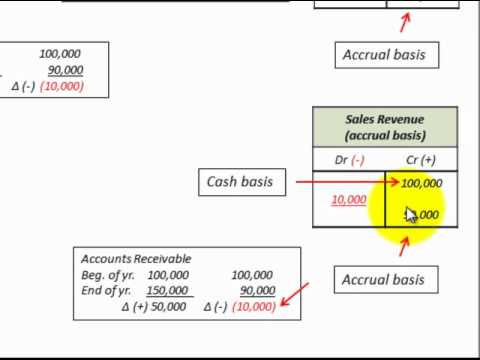

9 1 Explain the Revenue Recognition Principle and How It Relates to Current and Future Sales and Purchase Transactions Principles of Accounting, Volume 1: Financial Accounting

Content Recognize Revenue When Your Business Satisfies a Performance Obligation Revenue Recognition Principle (IFRS): Definition, Using, Formula, Example, Explanation Revenue Recognition: The Backbone of Accurate... Selengkapnya)